RAC Audit Compliance – The Obligatory Conformity

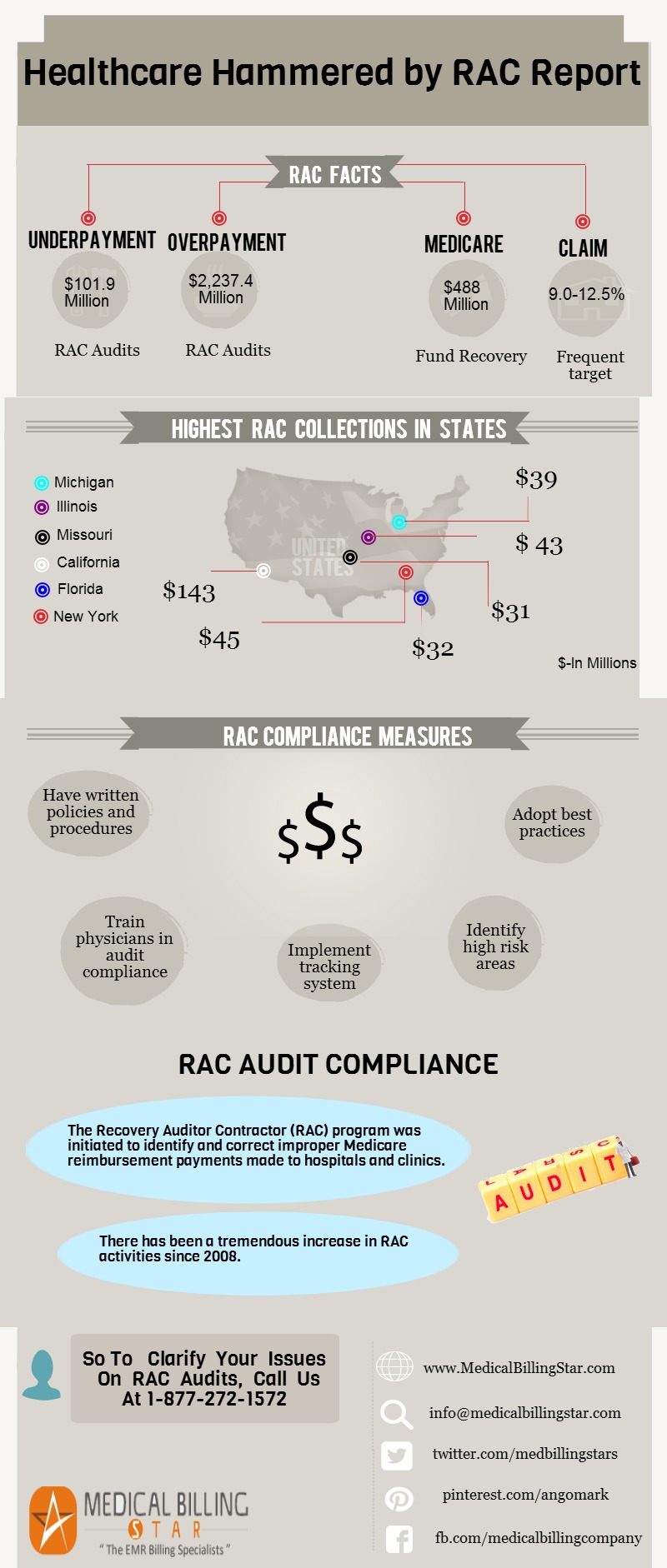

The Recovery Auditor Contractor (RAC) program was initiated to identify and correct improper Medicare reimbursement payments made to hospitals and clinics for claims for health care services provided to Medicare beneficiaries, and identification of underpayments to providers. There has been a meteoric increase in RAC activity ever since the program was initiated in 2008. The overall performance of the program has been satisfactory to some extent, as validated by the fact box :

RAC Fact Box

- Recovery auditors detected $797 million in overpayments and $142 million in underpayments.

- After taking all costs into consideration, underpayment determinations and appeal reversals – $488 million was returned to the Medicare trust funds.

- RAC collections were highest in the following states: California ($143 million), New York ($45 million), Illinois ($43 million), Michigan ($39 million), Florida ($32 million) and Missouri ($31 million).

The Modality

Recovery auditors employ a staff consisting of nurses, therapists, certified coders and a physician Certified Medical Dosimetrist (CMD). These auditors offer an opportunity for the healthcare provider to discuss improper payment determination. Issues reviewed by the auditor are approved by the CMS prior to widespread review. Approved issues are then posted to Recovery Audits Website.

Healthcare Providers’ Burden

Providers who agree with the Recovery Auditor’s findings pay by cheque, allow recovery from future payments, or request for extended payment plan. They otherwise appeal if they don’t agree.

Expert Tip to Avoid Penalty

According to Dawn Crump, HealthPort’s Vice President of Audit Management Solutions, “Audit Insights, hospitals and clinics must ensure that they are not billing for services beyond those they deliver, ensure that correct higher E/M levels are justified and reported, update themselves with RAC activity via the RAC websites, and shore up clinical documentation improvement (CDI) programs with an eye on known RAC targets and documented issues.”

Be Well-prepared for RACs to Avoid Embarrassment

Some of the many precautionary RAC compliance measures are:

- A. Have written policies and procedures in place to deal with RAC audit.

- B. Train physicians on these policies and procedures and their roles in audit compliance.

- C. Conduct self-audit : Conduct internal reviews to ensure that they are in compliance with the Medicare standards, guidelines and criteria for claims.

- D. Implement internal tracking system : Track RAC activity to minimize financial risk and ensure timely response to RAC to avoid denials.

- E. Designate an experienced and qualified compliance officer to coordinate and control RAC compliance activities.

- F. Look out for risk-prone areas : Identify high risk areas for proactive correction.

- G. Adopt best-practice techniques for appeals management :

- 1. Familiarize physicians with appeals process to reverse improper RAC actions.

- 2. Earmark experienced physicians to assist during appeals processes

- 3. Make physicians acquainted with medical necessity issues for both inpatient and outpatient services.

Always Bank on MedicalBillingStar for RAC Related Issues : MedicalBillingStar is more than happy to clarify your issues on RAC audits through its network of qualified professionals to clinics and hospitals across the US.