So, you have considered taking on the challenges of finding the best medical billing company for your medical practice.

We should all by now know that the healthcare industry’s reimbursement laws aren’t going to stay put and be as they are. The changes they undergo are constant and continuous. They are always reforming, molding and reinforcing themselves as the system matures, necessitating the need for constant financial vigilance amongst medical practices.

Associating with billing professionals has been the go to option for most, especially those who haven’t got a billing department annexed to their healthcare’s business frontier. Meaning that most of the billing endeavors would be taken care of by an outsourced billing company, and the providers would be free to go ahead with what actually matters most to them – patient care.

Now, back to hunting for a fitting company that will do your bidding (billing), without you having to worry about all the cumbersome processes associated with it anymore.

When you chose a wrong billing company, something similar can happen to your practice

But, what’s more to it is that choosing a ‘good’ medical billing service almost always guaranties an increase in collection rates, and reduction in overall rejection or denial rates!

So, outsourcing the RCM can result in your business making more money. And, since you wouldn’t have to allocate working staffs to take care of these tasks (coding and billing), they wouldn’t be feeling overworked and could work more efficiently. Or you could save further by simply cutting down on your no. of working staffs.

Either way, you are on the track to saving more while making more.

Now to the big question…

- How should you choose your billing service? As you will trust them with you business’s most important segment – the revenue cycle management.

The answer: By asking them a lot of questions! (Just like how you would, when interviewing an in-house billing faculty.)

And, to get you started with those question-sessions, here are 23 questions that you should consider asking to your would-be medical billing service provider.

We have split these questions under two categories ‘Pre’ and ‘Post’ subscription services/functionalities. Choose the ones best suited for your specific needs

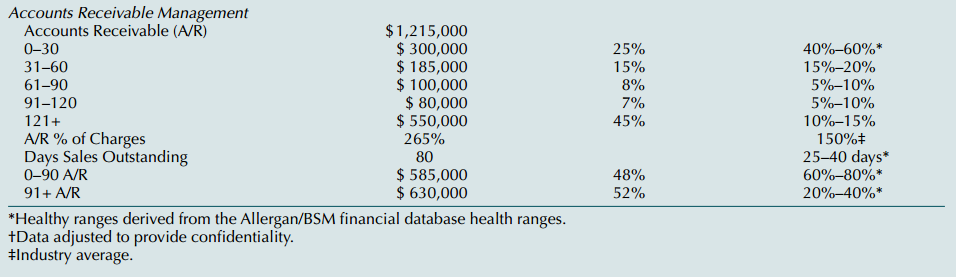

1. Do they provide a summary of your current ‘Accounts Receivable’?

Keeping your monthly AR under 1.5 times the monthly charges is the ideal target.

Measuring Accounts Receivable (Days in AR):

Days in AR = Total AR ÷ Avg. daily charges

(Where: Avg. daily charges = total charges in last 6 mo ÷ no. of days in these 6 mo)

As the AR days increase, cash flow to your healthcare organization decreases, thus lowering your means to pay or hire better staffs and physicians. Also, it affects your group practice’s ability to invest in current gen tools and technology. So, higher your avg. AR days the more negative its impact on your ability to treat patients better.

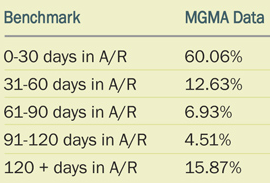

AR is grouped under 5 classifications, which are 0-30 days, 31-60 days, 61-90 days, 91-120 days and over 120 days. You can compare your AR Benchmark with MGMA Data here.(Best viewed in Chrome browser)

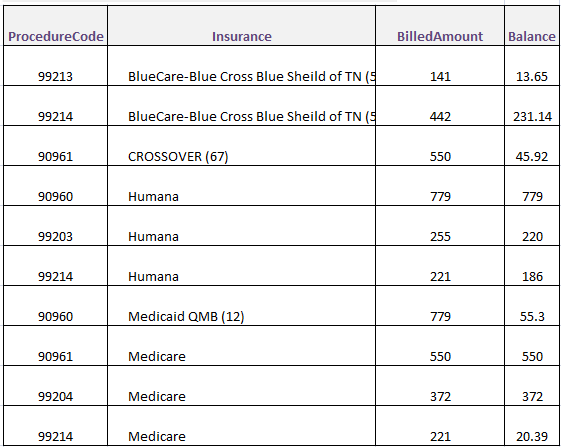

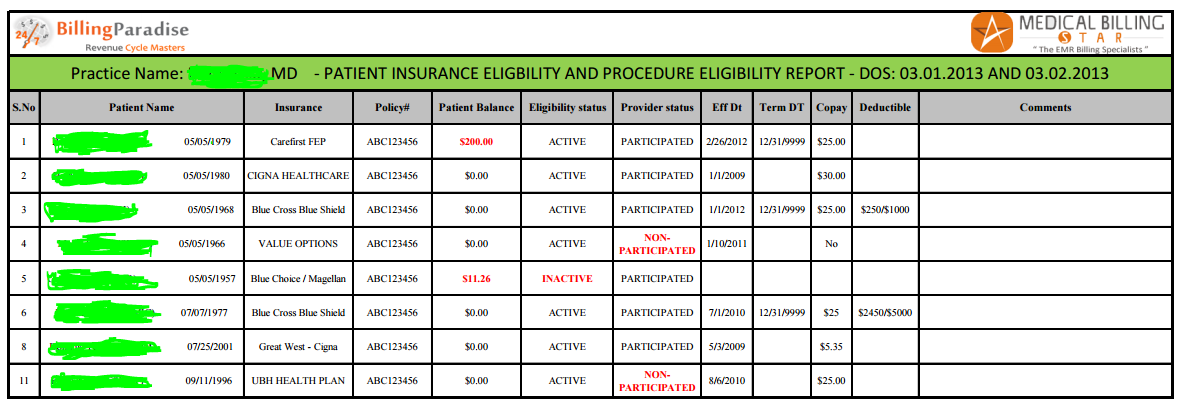

Check if they can help you with you in getting your current A/R summary. The below table is a summary of a practice’s bad A/R.

Other question you could be asking on that line…

- Do they have an organized system in order to keep track of and follow through with your pending AR?

- Would they be providing you with periodic analysis of AR, and assisting you with recommendations based off of it, so that your hospital’s overall financial performance can be boosted?

2. Do they offer ‘Denial Management’ on your existing claims?

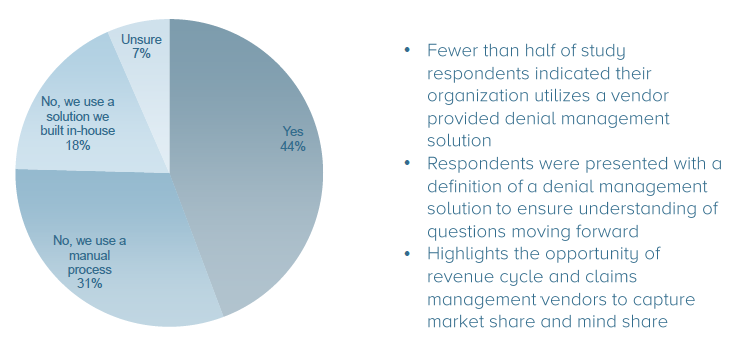

A HIMSS Analytics’ survey found; “44% of the participating hospital executives indicated that they use revenue cycle management vendor solution to manage denials, while 31% use manual process and 18% use homegrown tools, but surprisingly, 7% are unsure about their denial practices.”

Should the billing company be pursuing after your ‘denied’ claims or would it be better for the group practice to take responsibility?

Whatever maybe your choice; a proven fact is, a dedicated medical billing company is more capable/efficient at managing payer denials than a medical practice.

Do they have dedicated platforms to do that!

- Checkout if they utilize any denial management platform? If yes, then you may want to opt for a quick demo before proceeding.

- Also, do they incorporate a team dedicated for denial management? If yes, go for a con-call and throw in few of your existing concerns.

3. Can they keep track of and make analysis of your ‘Rejected Claims’?

A research notes; “about 20 to 30 percent of the claims that are raised get rejected on a regular basis.”

Another report suggests; “of these (rejected) claims, almost 80 percent are left unprocessed.”

Considering these reports where true, you are seeing an avg. of tens of thousands of dollars lost due to rejections every year.

Can a healthcare organization afford to face such loses?

From sloppy documentation to issues such as up-coding/under-coding, there are numerous reasons why your claim could get rejected.

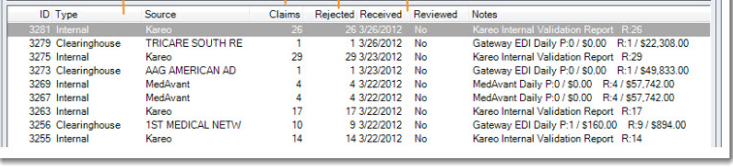

Check if you can get insights into unreviewed rejection reports like a one below:

And, you need a team of expert billers to handle all these rejections at a moment’s notice. An established billing company can afford that.

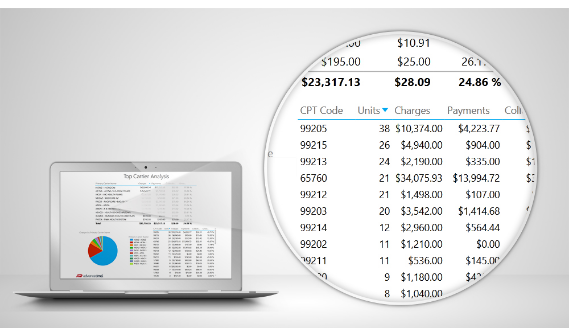

4. Can they offer a ‘Code Analysis’ based on your existing medical practice’s history?

Claim rejections, denials and low reimbursements are the primary causes of revenue undercuts in any healthcare organization.

So, reports such as ‘top used codes’, ‘top paying codes’ and ‘most denied codes’ go a long way in keeping you updated on revenue flow. A company that can work out these details and also provide you with alternate solutions (codes) that could save you from a lot of trouble and some money will prove to be a resourceful billing partner.

- Are they up-to-date with the industry’s latest tweaks & amendments?

On an added note; a billing company that ensures continual training & orientation of its staffs on the latest resource/updates in the industry, will give your organization an edge in revenue handling.

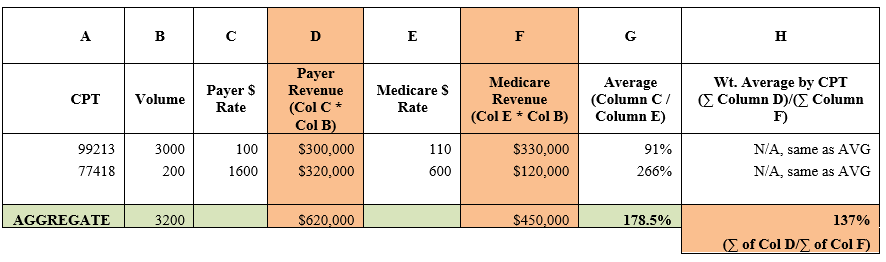

Let’s take a look at the analysis of the Top CPTs of a medical practice.

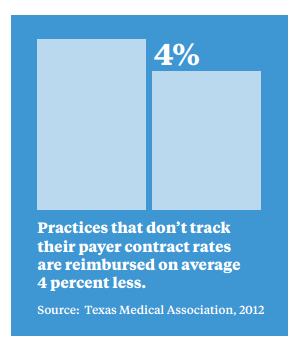

5. How good are they at ‘Contract Analysis’?

Coverage plans can change from state to state…

At some states they could offer extended coverage (including even comprehensive healthcare issues), yet at other states they may only cover the program’s set ‘minimum requirements’ laid down by the federal governments.

So, a billing company that can demonstrate in-depth expertise on those contract’s pros & cons, can significantly influence your healthcare’s revenue flow in a positive way!

6. Can the billing company add value to your business with their ‘Fee Scheduling’ knowledge?

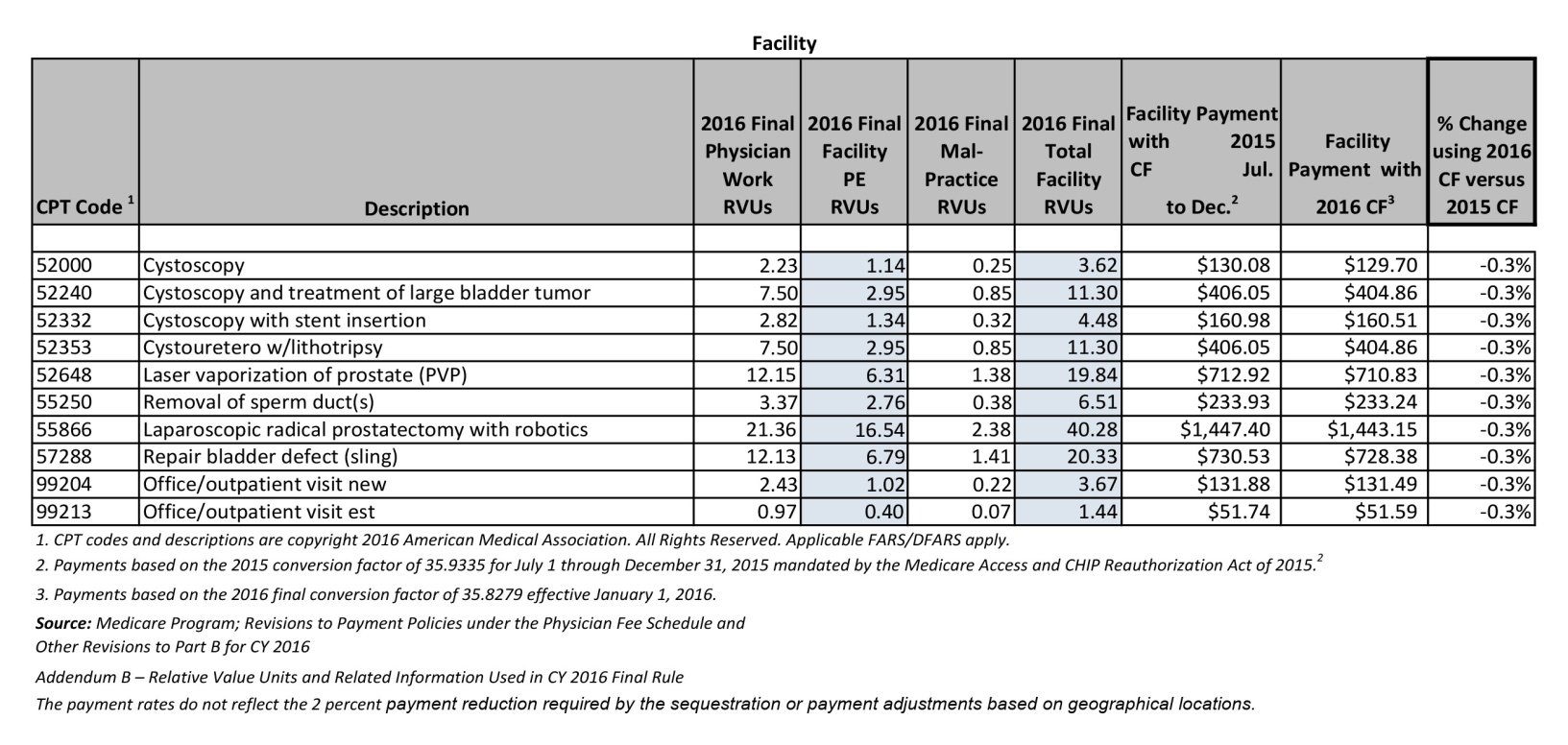

Medicare fee schedules are updated once every year, and when they do so, they bring a load of changes to your reimbursement values. So, it is mandatory of your chosen billing company to know the ‘widths’ and ‘depths’ of these Medicare updates. Check out medicare physician fee schedule for CPT codes in your city

An example:

Let’s say a doctor from California sees 1000 patients in a month, of those 1000 there are 500 patients who are billed under a single code, which is ‘CPT code: 99241’.

Let’s say Medicare pays $150 per claim for that code…

Hence, the total reimbursement you should receive will be 500 * $150 = $75,000.

Now, let’s consider that Medicare has revised the fee schedule for this code to $100 instead of its previous $150. Then, during your next billing you would be left with a negative difference of a whopping $25,000 as reimbursement.

…which shouldn’t come as a surprise to you if you are prepared for it!

That’s why you need a billing company that’s aware of these changes, and is capable of passing on to you the warnings – on time and effectively.

Now; these six questions should get you through the pre-subscription short-listing process of your ‘medical billing company’ hunt. Further, the remaining questions will help you filter down your choices, based on their services/offers and your organization’s specific needs.

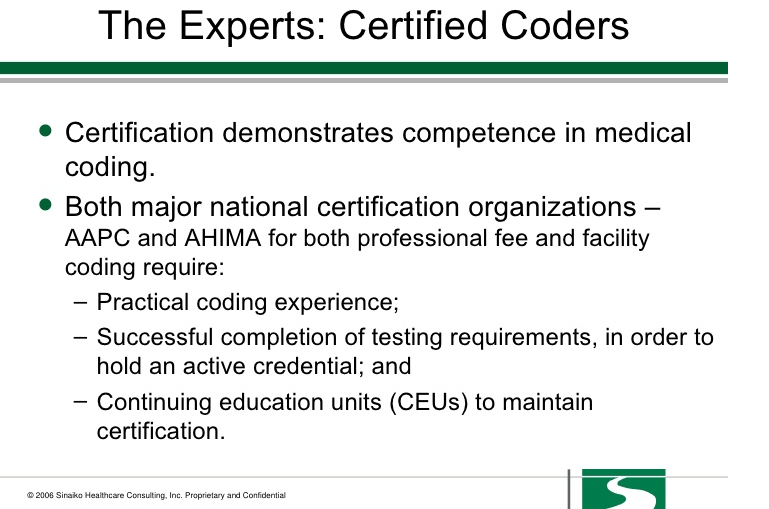

7. Do they have ‘Certified’ coders taking care of your coding needs?

About 80% of rejected claims are the results of wrong coding!

Under-level coding and general coding can leave constrains on your revenue flow, so, ensuring if the billing service providers will handle your coding processes with certified coders should be on the top of your need-to-do list.

Coding to the highest level of specificity will help you get the most for your services. So, that’s what the billing company must be proficient at.

8. Do they utilize ‘Specialty Specific Coders’?

While any experienced billing company can boost your productivity to a certain degree, a professional with expertise in your ‘specific specialty’ can do even greater good for your organization.

And a billing company with a collection of ‘specialty specific coders’ can potentially shift your revenue graph north almost instantaneously!

9. Do they offer ‘EMR Specific Billers?

Why EMR specific billers? Because, they can fit right in with any EMR the doctor is currently using.

Most common issue that the doctors face when having an in-house billing team is that they aren’t tech-savvy enough to handle claim operations through the EHR/EMR chosen by the doctors. And doctors aren’t trained to handle the revenue processes, but, only in treating the patients. This often leaves a void at the business aspect of a medical practice.

So, when a medical billing company offers EMR specific teams, you can rest-assured that your claim submission processes will see a massive boost. As an added bonus, these experts will be able to better navigate across the EMR software allowing them to effectively export revenue kpi performance reports.

End of the day, it is important for every medical practice to keep track and analyze their past week’s/month’s revenue performance, isn’t it?

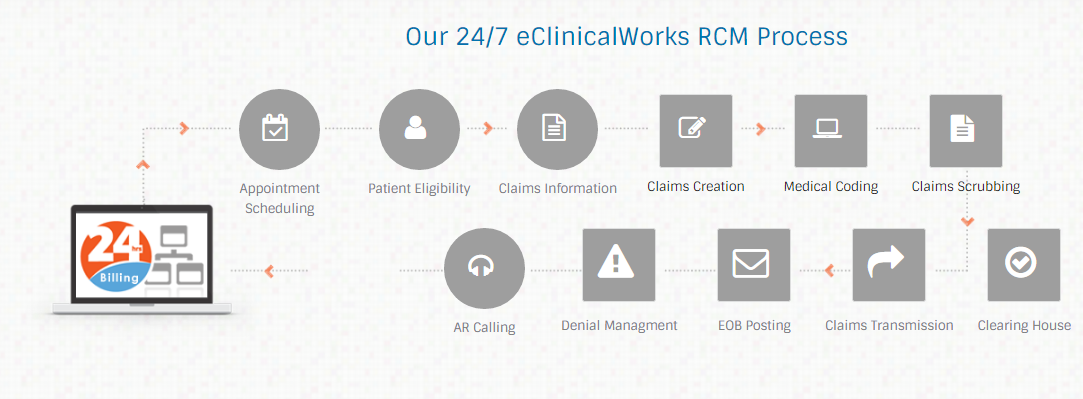

Here’s how a sample for to help you question an eClinicalWorks RCM company on it’s workflow

10. Will they offer ‘Patient Eligibility Verification’ services?

Medical practices being aware of patient eligibility saves a lot of hassles when it comes to patient tracking & payments further down the line.

As missing out on eligibility verification prior to patient visit can leave you revenue-vulnerable it becomes a mandatory process, but, one that takes a lot of effort and dedicated resources to handle. So, when a billing company can offer it for you, it’s an advantage you wouldn’t want to miss.

Advantage of patient eligibility verification…

- Allows you to be aware of the patient’s payment responsibility ‘estimates’ ahead of the treatment

- Also, patients can be intimated of these estimates beforehand, helping them be prepared or keep their options open as they make the visit

Thus, you are more likely preventing most of patient payment issues, (especially the ones due to patients being unaware or incorrect about their insurance coverage).

But, we must all agree that insurance information is often confusing and is likely to change often. So, keeping patients aware of their coverage plans will allow them to make payment on time, which most patients want to.

Compare the billing companies insurance eligibility verification process with this sample report

11. Are they having separate teams for handling claims, rejections and denials?

Reimbursement models are continuously evolving, and medical billing companies can provide you with the most expert solution to tackling current claims, rejections and denials scenarios. However, what you should be looking for is how well they are equipped for meeting future needs as well.

Choosing a billing company that has individual teams to handle different sects of revenue cycle can ensure that they are well equipped to tackle the evolving trends quickly and efficiently.

12. How transparent are their reports?

To begin, let’s question yourself; was your previous medical billing company producing revenue reports that you were able to review on a regular basis?

- Where you able to retrieve ‘specific’ details from these reports?

- Where you sure of the accuracy of those produced reports?

- Where you able to compare the sent reports with the industry’s standard benchmarks?

Well, these are all part of the components that affect your company’s financial growth; and only a billing company that can offer these reports ‘transparently’ can allow you to achieve maximum financial growth.

Note: Now that the mobile applications are ruling the technology world, does your biller offer opportunities to produce reports through mobile apps?

13. Is the medical billing company offering any dedicated revenue reporting app/platform for the organizations to keep track of their revenue whenever needed?

Today’s environment demands vast knowledge and expertise in handling reimbursements. Certain companies may counsel different technologies to meet both regulatory requirements as well as your specific needs.

From practice management tools, billing system to different IT solutions, however, certain billing companies offer dedicated platforms and revenue reporting applications. These companies should be able to better integrate your revenue setup such that the collection process is more effective.

14. Can they offer benchmarking services to track your doctors’ productivity levels with other doctors in the area?

Conducting benchmarking on regular basis will help track the progress of physicians in your group practice. Assessing and comparing performance metrics will allow you to test your standing on the industry’s standards.

Why benchmarking is important?

Because, it is one of the best ways for finding problem areas and opportunities

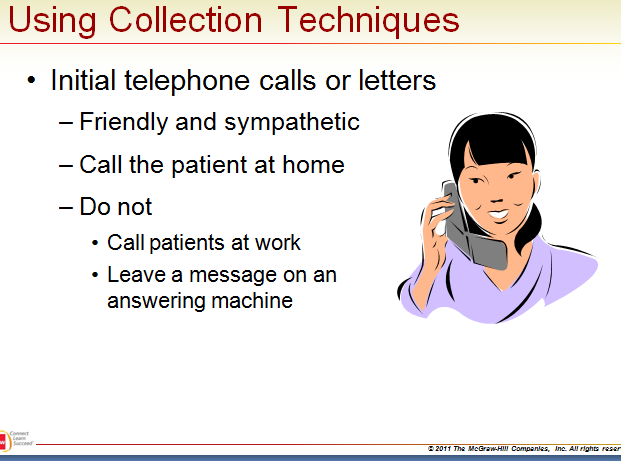

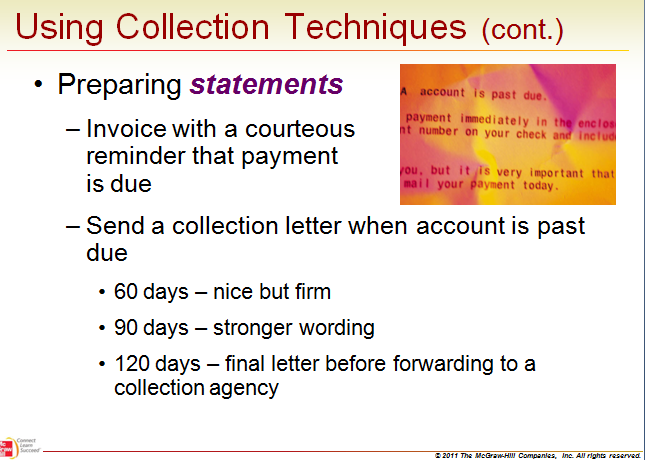

15. Do they offer patient billing services?

Who follows up when a patient doesn’t pay his/her bill?

A medical billing company that can correspond with your patients, who don’t pay their bills on time and/or handle your organization’s similar billing concerns, can become a valuable asset to the business.

As, outsourcing to such companies will help optimize your revenue collection practices significantly!

Check out their collection techniques. How do they follow up with? A sample procedure:

16. Are they engaging ‘Insurance Specific Calling Teams’?

How import is it to have dedicated calling teams for different payers?

Primary reason for opting for insurance specific calling teams is that with experience they know what the fine prints say. They know what the reasons behind different denials and rejections would be. And they know how to answer in the language of (how to handle) the particular insurance company.

And since over 30% of most practice’s revenue comes through AR, a payer specialized service will be more efficient at collecting than a general biller.

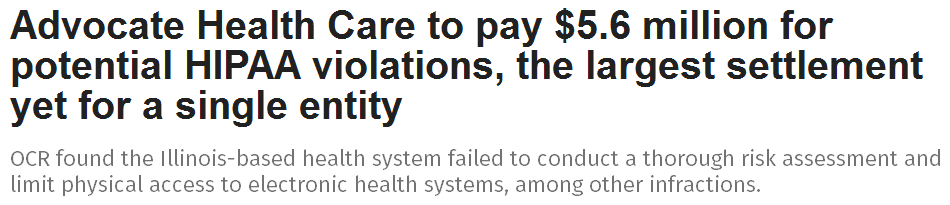

17. Is the billing company ‘HIPAA Compliant’?

Handing over your patient’s medical information to other third-party organizations is a huge responsibility as you become liable for legal issues.

So, ensuring the billing service provider is HIPAA (Health Insurance Accountability and Portability Act) compliant is a must. Privacy, security and confidentiality of the protected health information (PHI) must be practiced rigorously.

News like the ones below should alert you on doing a rigorous check:

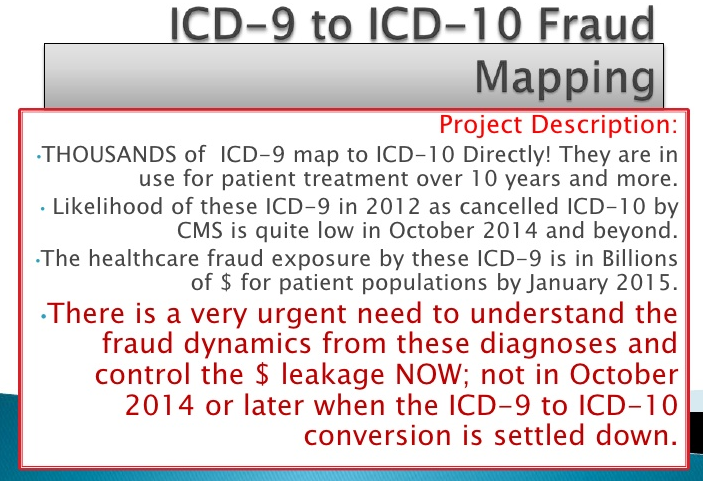

18. Are their teams well-versed at mapping codes from ICD9 to ICD10?

Like already discussed a number of times, since the healthcare billing regulations are changing rapidly, it is vital to ensure that the billing company you are opting for is playing an active role when it comes to healthcare revenue cycle management.

You should look up for information on how the company is staying updated with these changes and how effective their ICD10 coding service is.

Now this is what I mean when I said well-versed in mapping:

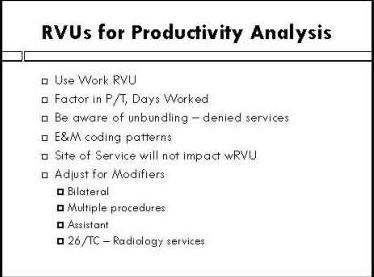

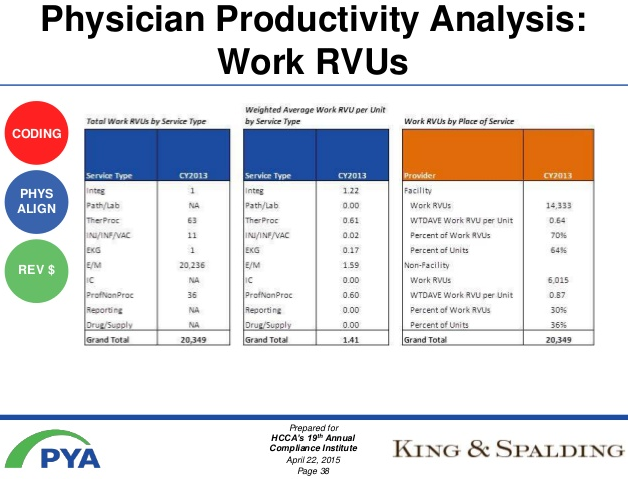

19. Will they be providing ‘RVU Analysis’ specific to your healthcare organization?

RVU analysis allows you to determine the performance of your individual physicians based on their contribution to the organization.

Since it is consistent across the nation and is vetted by specialty societies; they are much more appropriate for benchmarking when compared to other values. (Example: Charges are arbitrary, costs are often unknown and encounters don’t show the intensity.)

A professional billing company offering this service can automate the evaluation process for you.

And, here’s what you need for RVU Analysis and how it comes up:

20. Do they offer ‘Contract Negotiation’ services to maximize your revenue?

Improper contract negotiations have known to hold down 10-30 percent of a business’s revenue; however, an expert in the field can help negotiate aggressively and yet maintain a formidable balance with the payers.

The process of contract evaluation and negotiating is complex, and frankly most of the staffs in a healthcare organization wouldn’t have the time or expertise to handle it.

From auditing Explanation of Benefits (EOB) to scheduling renegotiation reminders and verifying termination deadlines, there are a lot of painful steps involved with contract negotiation.

A fine way to tackle it would be to let the billing company handle this process entirely. Outsourcing it can potentially increase your revenue, and save you a lot of time while at it.

21. Would they assist the medical practice in ‘Credentialing’ with a specific insurance company?

After long hours of documentation, regular follow ups and lots of ‘on hold’ minutes, you can finally expect to get credentialed (in-network) with the insurance panel you want to be a part of.

Or you could have someone else help with all the meticulous procedures and simply get on with getting your credentialed… Ok’ed!

22. Do they schedule weekly/monthly governance meeting?

A major benefit of hiring medical billing services is that they will be having better business insight when compared to the provider’s team. This should allow them to provide valuable feedback on how your organization is performing and how it can be improved.

Would you rather prefer a one-page statement each month?

But, a billing service provider who organizes weekly or at the least a monthly governance meeting should allow you to handle billing issues better by giving you valuable feedback on the business part of your medical practice.

Doctors and the billing company can have a discussion to come to the next step of action and improvements required.

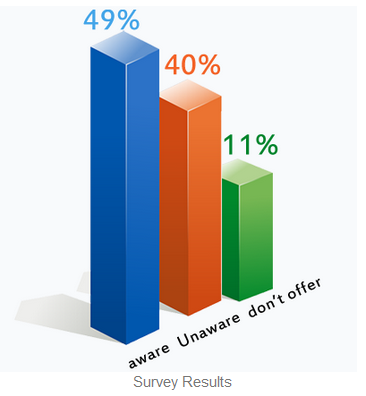

23. Are they having teams who can manage ‘Patient Support’ and ‘Patient Portal’ to assist you with patient management?

Offering alternate ways for patients to keep in touch with your healthcare adds value to your organization. They will appreciate communicating with the providers, being able to keep updated in-between visits and the convenience in general.

Likewise, providing patient portals for better overall patient management is a welcome accessibility not just to the patients but the physicians themselves. From setting up appointments, to asking and answering clear and pointed questions (where email volumes would be problematic), these portals are very effective.

But, they also mean setting-up dedicated additional resources both technology-wise and staff-wise. This could add on to an all already complex revenue management.

Then, there are some billing companies who offer these service as well; with dedicated teams to handle them expertly.

- 40% of patients have no idea of patient portal benefits

- 49% said their doctors have portals

- 11% said their doctors don’t offer portals

This is the first roadblock to using a portal. So if your billing partner can help you in creating a plan to make your portal usage a success, it would be an icing on the cake.

And Remember:

What must be considered is that as the no. of rendered services increase, so does the cost/fees. The healthcare practice must engage a proper balance by considering their in-house proficiency and the billing company’s expertise to work out a cost effective, performance-centric solution.

And, keep in mind, that you get what you pay for. Lower costs aren’t always the better option, and a lower fee of smaller bottom line doesn’t always save money!

Leave a Reply